고정 헤더 영역

상세 컨텐츠

본문

I would like to summarize and introduce the container market forecast data from BIMCO.

1. World Economy

-. The International Monetary Fund (IMF) lowered its forecast for global economic growth in 2022 to 3.2% and 2.9% in 2023, emphasizing that the risk of a global recession has risen. In particular, further downside risks exist, and the IMF's worst-case scenario forecasts further declines in global GDP to 2.6% and 2.0% in 2022 and 2023, respectively.

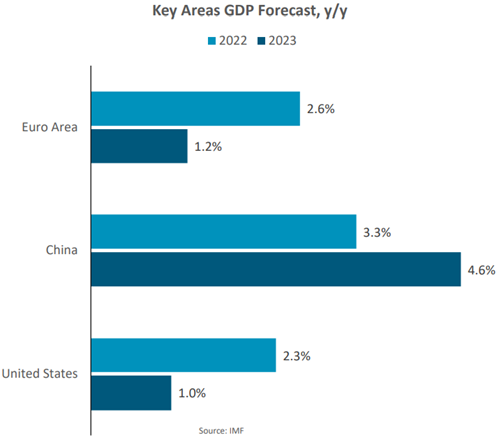

-. The EU and US are expected to show slower-than-expected growth. While the EU's growth forecast is 2.6% and 1.2% in 2022 and 2023, respectively, the US economy is projected to grow at 2.3% in 2022 and 1.0% in 2023, down from 5.7% in 2021.

-. In the case of China, the economic growth rate is expected to recover somewhat to 4.6% in 2023, after hitting a 3.3% low in 2022 and rebounding.

-. Looking at the manufacturing PMI, the rapid decline in the US and Europe is notable. On the other hand, Vietnam continues to record a PMI in the mid-50s, showing a remarkable recovery in the manufacturing industry.

-. Globally, it is considered as the time before the economic contraction just before 50 or below.

-. U.S. retail inventories have grown rapidly and rapidly since July 2020. It is estimated that retail inventory will decrease in FY23 if inventory is depleted, such as at the end of this year and Christmas.

2. Demand Status

-. Head-haul and regional volumes are expected to decrease by 1-2% in 2022 and increase by 3-4% in 2023, but there are many risks. A 12% year-over-year decline in the value of the EUR/USD exchange rate leads to a decline in purchasing power in Europe. This implies the possibility of a lower economic growth rate than the IMF's forecast in the future.

→Head-Haul : Asia-> Europe/North America route

→Back-Haul : Europe/North America -> Asia route

-. In the first half of 2022, container volumes for head-haul and regional trade declined 0.2% y/y, but outpaced 2019 pre-COVID volumes by 8.0%.

-. The volume of imports from North America/Latin America/Europe, which was very high until Q2 of 2021, has significantly declined since 3Q21, and as of Q2 of 22nd (y/y), the volume of imports from Europe has turned to a decreasing trend.

3. Supply Outlook

-. The market situation, which has risen since the corona virus in 20 years, has been a factor in record container ship orders in 2021. Looking at the graph below, 4.3M TEU was signed in 2021, and 2.5M TEU is expected to be signed in 2022 as well.

-. Ships ordered in this way are expected to arrive on the market in about 2 to 2.5 years after going through a ship building cycle.

-. Ships of 2.3M TEU are expected to arrive in 2023. In addition, adding the recent downward trend in freight rates, if a scrap of 0.3M TEU proceeds, the net increase is expected to be about 2.0M TEU.

-. Container capacity overall is expected to increase by 2.9% in 2022 and 8.0% in 2023. In particular, an oversupply is expected as ships placed on record orders in 2021 arrive after 2023.

4. Conclusion

-. From 2023 onwards, the implementation of EEXI will become a more important factor related to ship demand. EEXI estimates that low sailing speeds could increase vessel requirements by 5%. Since then, Maersk has announced that it will need 5-15% more ships and Hapag-Lloyd estimates an increase of 5-10%.

-. Port congestion could go away by 2022 or at the latest spring 2023. A drop in shipments to the US and a notable drop in truck usage will help clear congested container yards. In Northern Europe, recent strikes have temporarily exacerbated the problem, but it is unlikely to have a major impact if year-round low volumes continue for the rest of 2022.

-. Demand : 10% increase in ship demand in 2023 due to EEXI

-. Port Congestion : Congestion is reduced by 7-8% (the effect of increasing supply)

-. Fleet Capacity : Increases fleet capacity by 8%.

-. Finally, cargo demand (supply) increases ship demand (demand) by 3-4%.

Therefore, it can be concluded that the time charter rate and secondhand ship price will decrease in 2023 due to the deterioration of supply and demand factors.

'Forecast' 카테고리의 다른 글

| BDI & SCFI prediction (‘23/12W) (0) | 2023.03.27 |

|---|---|

| BDI & SCFI prediction (‘22/28W) (0) | 2022.07.11 |

| BDI & SCFI prediction (‘22/27W) (0) | 2022.07.03 |

| [IMPORTANT] Inspection of market conditions by ship type/year(Forecast) (‘22/June) (0) | 2022.06.30 |

| BDI & SCFI prediction (‘22/26W) (0) | 2022.06.26 |

댓글 영역