고정 헤더 영역

상세 컨텐츠

본문

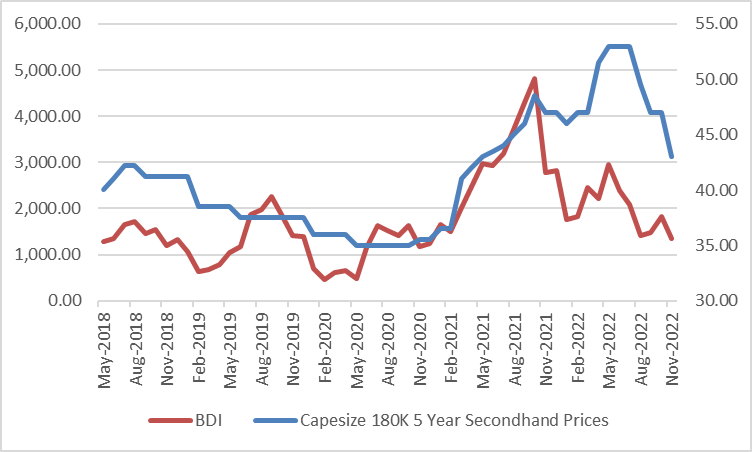

1. Relationship between BDI and Cape used ship price

Let's take a look at the monthly price trend from 2018. It can be seen that BDI and used ship prices are moving in a similar pattern.

However,

- From May to November 2018, used ship prices continued to fall despite the sharp rise and fall of BDI.

- Similarly, in May-August 2020, BDI rose sharply, but used ship prices still fell.

In summary, it can be seen that the used ship price is much more inelastic, and when it exceeds the appropriate BDI standard (about 2000, BEP), the price becomes much more elastic, but below it (low market conditions), it is inelasticly weak. .

On a monthly basis, the current November price of BDI is 1,350, and used ship prices are expected to decline further for the time being.

2. Correlation

The simple correlation between BDI and used ship prices shows a positive (+) correlation of about 0.6. From a social science point of view, a correlation of 0.5 or higher can be proven to exist, so a value of 0.6 can be said to be a high level of relationship.

3. Regression

Regression: BDI = -2463+(102*Secondhand Prices)

Regression analysis was performed with the above two variables. The dependent variable used BDI and the independent variable used the used ship price, and the regression equation is as above.

As of November 2022, the price of used ships is 43M USD, and the average price for the last four years is 40.31M USD. That is, it seems to be located between Case 1 and Case 2, and when the regression equation is substituted, the appropriate BDI is about 1,700. At this level, the current BDI appears to have plunged excessively.

Therefore, it appears that there is room for about 20% of the upside level.

thank you

'Dry Bulk' 카테고리의 다른 글

| What is a bulk carrier? ② Focusing on BDI index composition, trend and volatility (0) | 2023.02.06 |

|---|---|

| What is a bulk carrier? ① Focusing on ship types and cargo volume (0) | 2023.02.01 |

| Bulk carrier market outlook(2023/2024) (0) | 2022.11.04 |

| Bulk Carrier Shipping Market (‘22/30W) (0) | 2022.07.26 |

| Bulk Carrier Shipping Market (‘22/28W) (0) | 2022.07.13 |

댓글 영역