고정 헤더 영역

상세 컨텐츠

본문

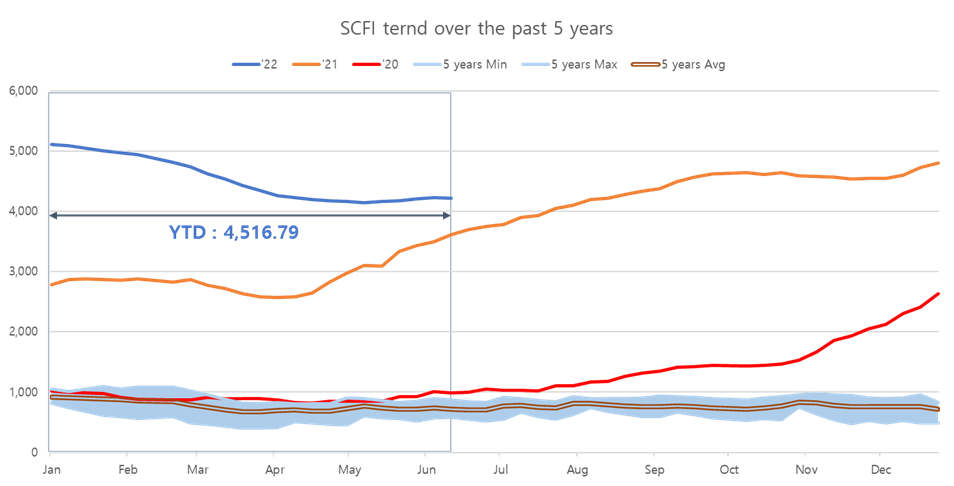

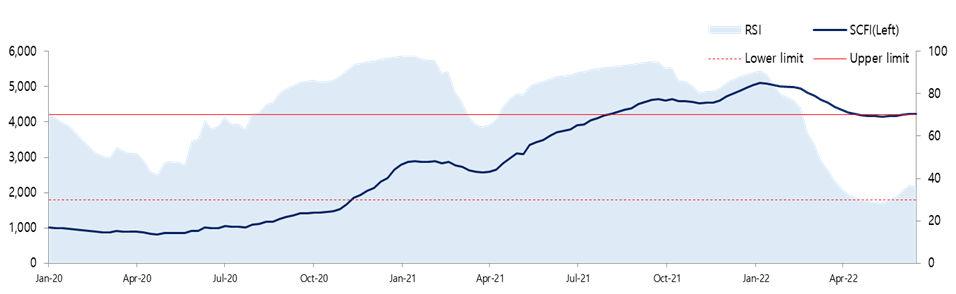

SCFI rates ended a four-week uptrend. SCFI, a global shipping rate index, recorded 4221.96 as of the 17th, down 11.35 points from the previous week.

The SCFI peaked above the 5,100 level for the first time in January, and fell for the 17th week in a row. Since then, the decline has decreased, and then rebounded on the 20th of last month for the first time in 18 weeks. It continued its upward trend in the last 4 weeks, but it is counted that it has declined slightly again this week.

1. Weekly Market Briefings

◦ In the 24 weeks of 2022, the SCFI Composite Index recorded ‘4,222p’. The rate of increase in Middle East and South America routes slowed, and SCFI turned to decline for the first time in 4 weeks

- After the Shanghai lockdown was lifted, most of the manufacturing facilities were normalized, but quarantine in the area was maintained strong, resulting in logistics restrictions such as truck movement.

- Concerns about a global economic contraction due to the rapid US interest rate hike and increased uncertainty also weakened consumer sentiment in major regions, adversely affecting trade volume.

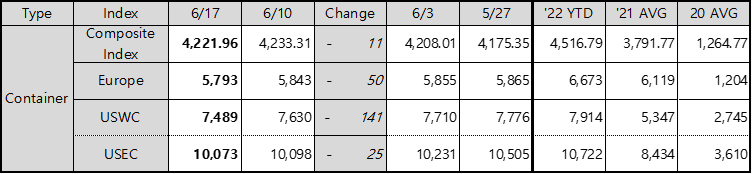

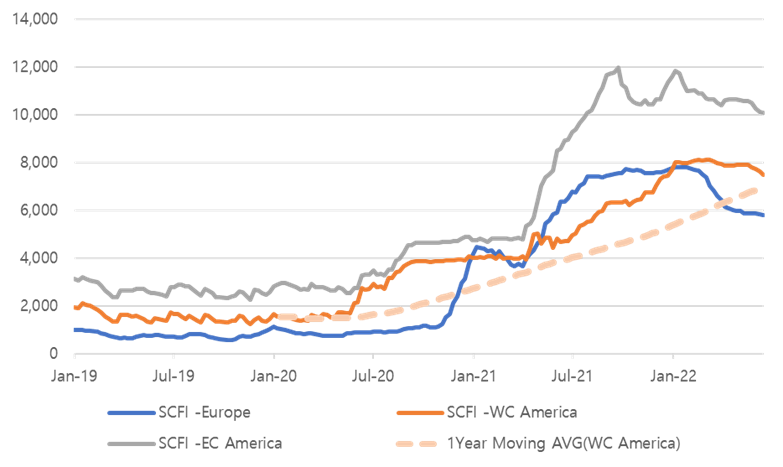

2. Index Trend(Composite / Europe / USWC, USEC)

2-1. Europe :

- European routes declined for 3 weeks in a row

- The market continued to remain weak as demand contracted due to the effect of increased inventory and inflation in the eurozone.

- German port unions demand a wage increase as compensation for inflation and hold warning strikes in ports such as Hamburg and Bremen.

- The UK's Railroad and Marine Transport Workers' Union (RMT) also announced a strike in June, increasing the possibility of transportation disruptions in Europe.

2-2. USWC/USEC :

The West Coast of the US fell for the fifth week in a row, and the East Coast route fell for the fourth week in a row

- The US Consumer Price Index (CPI) in May rose 8.6% from the same period of the previous year, intensifying inflation. In response, the US Federal Reserve (Fed) took the first “giant step” in 28 years to raise the policy rate by 75 basis points at the FOMC meeting in June. Growing concerns about slowing consumption due to inflation and sharp interest rate hikes

- Regarding the labor-management agreement at the Western Port, ILWU-PMA announced that there would be no strike through a joint statement after the meeting with President Biden, and promised to reach labor-management negotiations.

However, it is unclear whether the agreement will be reached before the expiry of the current agreement on July 1st.

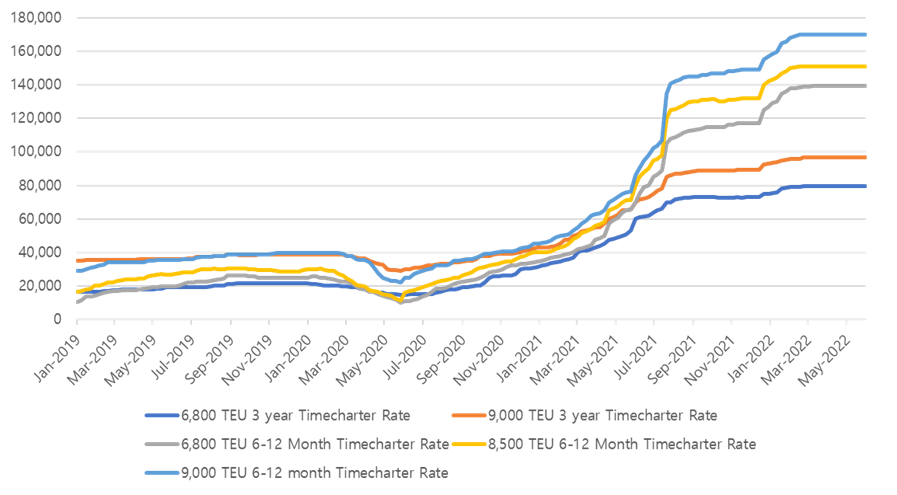

3. Time Charter Rate

The TimeCharter rate for each container line/period is the same for 15 consecutive weeks, and there is no movement. The charter rate, which remains unchanged despite the rising and falling movements of the SCFI, is expected to plunge rapidly when the container market declines along with the global economic slowdown.

Ref ) Container Shipping Market (‘22/24W) (tistory.com)

Container Shipping Market (‘22/24W)

Global shipping rates(SCFI) rose for the fourth week in a row. While routes to the Americas and the Mediterranean continued to decline, South America and the Middle East continued to rise. ccordin..

shippingmarket.tistory.com

4. Technical analysis

MACD : October 08, 2021, Trade signal (Short Position establishment) signal occurred. Considering the fact that it turned downward after a four-week rise, it is expected that the MACD will continue to decline rather than change its trend. So the change in position is the same.

RSI: As of June 10, 2022, the RSI was 36.98. As in the 23rd week analysis, technical analysis recommends a buy position in the short term. As of June 17, 2022, it recorded RSI of 36.30, a decline from the previous week. As a result of reflecting the latest freight rate trends, we recommend a short position even in the short term.

5. Conclusion

The industry does not expect the downtrend to last long due to the lifting of the lockdown at Shanghai Port and the increase in cargo volume due to the peak season in June.

But, as in the previous analysis (conclusion), I expect the market to weaken due to the global economic impact.

Thanks.

'Container' 카테고리의 다른 글

| Container Shipping Market (‘22/27W) (0) | 2022.07.04 |

|---|---|

| Container Shipping Market (‘22/26W) (0) | 2022.06.27 |

| Container Shipping Market (‘22/24W) (0) | 2022.06.13 |

| Container Shipping Market (‘22/23W) (0) | 2022.06.08 |

| Container Shipping Market (‘22/22W) (0) | 2022.05.31 |

댓글 영역