고정 헤더 영역

상세 컨텐츠

본문

Global shipping Freights(SCFI) continued to rise for the third week in a row. On the other hand, routes to the Americas and the Mediterranean continued to decline, continuing the weakness during the same period.

According to the market on the 3th, the SCFI recorded 4,208.01 as of the 2nd, up 32.66 points from the previous week. As a result, it has recovered to the 4,200 level after about a month and a half since April 15th.

1. Weekly Market Briefings

- ◦ In the 22nd week of 2022 (5.30~6.3), the SCFI Composite Index recorded ‘4,208p’. Despite the decline in North American routes, it rose for the third week in a row thanks to strong Middle East and South American routes

- China's Caixin manufacturing PMI in May recorded 48.1, up from 46.0 the previous month. Although the economy is still sluggish, below the economic junction (50), the June index is expected to improve as the lockdown in Shanghai is lifted on the 6th.

- Global reliability in April stood at 34.4%, continuing the overall slump. However, the average number of delay days was 6.4 days, which is improving after the peak (8.0 days) recorded in February '22.

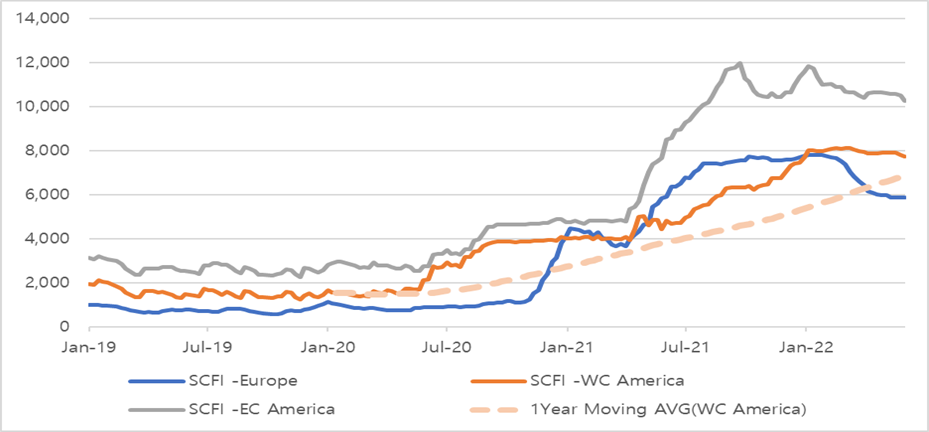

2. Index Trend(Composite / Europe / USWC, USEC)

2-1. Europe :

- Slight decrease compared to the previous week on European routes.

- Overall, supply and demand have been stable, so there has been no significant change in freight rates or volume recently.

- The N.Europe reliability in April recorded 19.2% (▼5.3%p from the previous year, ▲4.9%p from the previous month), and 31.8% for the Mediterranean Sea (▲1.1%p from the previous year, ▲1.3%p from the previous month), improving overall compared to the previous month

2-2. USWC/USEC :

- ◦ The West Coast of the US fell for the third week in a row, and the East Coast route also fell for the second week in a row.

- Weakness freightes despite the temporary suspension of shipping by shipping companies due to sluggish demand due to inflation concerns and economic slowdown.

- Labor-management agreement on the western port of the United States resumes on the 6.2nd after a 10-day break from negotiations.

- In April, reliability in the US West Coast was 21.0% (▼0.7%p from the previous year, ▲1.4%p from the previous month), and 21.7% for the east coast (▲1.9%p from the previous year, ▲2.0%p from the previous month). Both east and west improved from the previous month.

3. Time Charter Rate

Looking at the analysis of the last week (22W), my opinion is still the same. In addition, despite the lifting of the lockdown in Shanghai, China, 1) the SCFI does not show a clear upward trend and 2) the time-charter rate does not rise further, so a downturn is expected soon.

HMM (CODE: 011200) stock price also returned most of the upward trend last week. As we said last time, I recommend selling in the short term.

Ref ) Container Shipping Market (‘22/22W) (tistory.com)

Container Shipping Market (‘22/22W)

The global container freight rate index(SCFI), which rebounded for the first time in 18 weeks, rose for the second week in a row. According to the industry, the Shanghai Container Freight Index (S..

shippingmarket.tistory.com

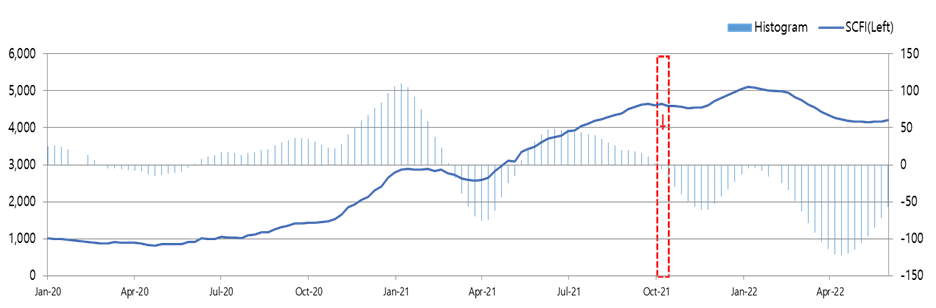

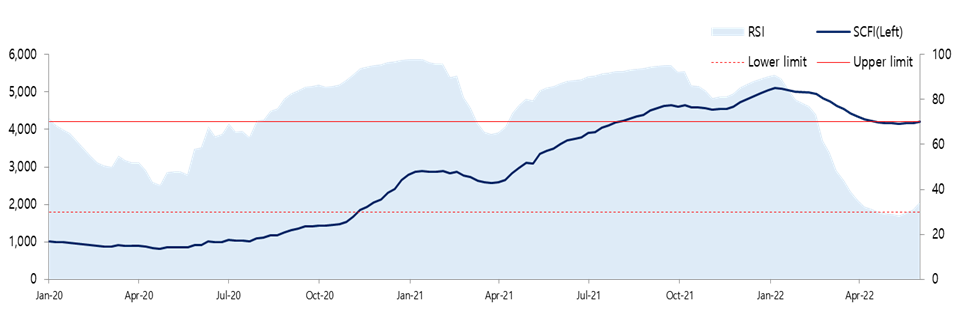

4. Technical analysis

MACD : October 08, 2021, Trade signal (Short Position establishment) signal occurred. It has been sending down signals for the 34th week in a row.

RSI: As of June 3, 2022, it recorded RSI of 34.45. As in the 22nd week analysis article, technical analysis recommends a Buy position in the short term.

5. Conclusion

The industry observed that as the lockdown in Shanghai was completely lifted, supplies that had been pushed back could be poured out all at once. In this case, the rise in shipping rates is expected to be difficult to avoid. Moreover, given that June is a peak season for logistics, the consensus of experts is that the rate of increase in freight rates can be further expanded.

Nevertheless, given concerns over a global economic slowdown and limited rebound in freight rates, I expect a steep decline after a moderate rise rather than a sharp rise in freight rates.

Thanks.

'Container' 카테고리의 다른 글

| Container Shipping Market (‘22/25W) (0) | 2022.06.22 |

|---|---|

| Container Shipping Market (‘22/24W) (0) | 2022.06.13 |

| Container Shipping Market (‘22/22W) (0) | 2022.05.31 |

| Market updates: Container market – May 2022 (0) | 2022.05.27 |

| Container Shipping Market (‘22/21W) (0) | 2022.05.23 |

댓글 영역