고정 헤더 영역

상세 컨텐츠

본문

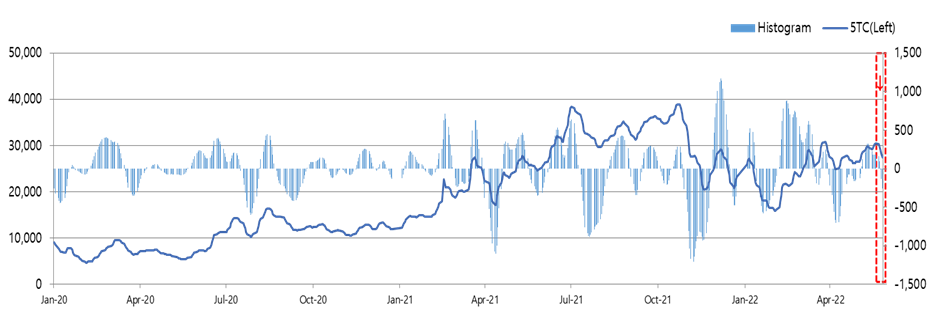

On May 27, the Baltic Dry Index (BDI) closed at 2,681, down 252 points from the previous day. Last week, the bulk market was down in all directions, with the Cape market crashing. According to foreign media, the maritime freight futures trading (FFA) market showed a slump, which had an effect on the slump in the market.

The Cape Freight Index (BCI) recorded 2,818, down 660 points from the previous day. This week is expected to show a recovery from last week's crash. In the meantime, shipments have been delayed due to a shortage of ships.

1. Capesize Weekly Trend

1-1. Weekly Market Briefings

- ◦ The Chinese government, in a statement on the 25th, emphasized the “balance of the economy and the quarantine,” but did not announce an additional fiscal expansion plan.

◦ Chinese Premier Li Keqiang emphasized ‘maintaining the balance between economy and quarantine’ at a meeting with local governments on May 25th.

- The steel and iron ore demand outlook sharply shrinks as no plans for further fiscal expansion policies that market participants had expected were announced.

- Predictions that China will stick to its zero-corona policy raise the possibility of a re-lockdown, putting pressure on market sentiment. - ◦ Despite a sharp deterioration in market sentiment, China's iron ore inventories have been declining for the ninth consecutive week. Therefore, the cape market is expected to try to secure a short-term low in the near future.

1-2. Technical analysis

MACD : May 26, 2022, Trade signal (Short position establishment) signal generated.

RSI : As of May 20, ‘22, RSI is located above 85. Last week, the RSI moved between the 84-88 level. The index rose toward the second half of the week, and as of May 20, it exceeded 88, indicating a short-term high. In other words, the RIS technical analysis shows a sell advantage signal in the CAPE market.

2. Panamax Weekly Trend

2-1. Weekly Market Briefings

- Panamax market has 10% declined for the week as sentiment weakened by the Cape plunge and sluggish coal demand in China and India.

- Reduced electricity demand burden due to increased rainfall and lower temperature due to monsoon in some parts of India - China's import demand continued to slump due to the recent expansion of its domestic coal supply. In the current Chinese market, domestic coal is cheaper than imported coal, so imports are unlikely to increase before a surge in electricity demand during the heat wave.

2-2. Technical analysis

MACD : May 25, 2022, Trade signal (Short Position establishment) signal occurred.

RSI : Panamax 5TC also fell about 10% along with the plunge in the Cape. The RSI index also recorded 40, but given that it is a dead cross section like the cape, I recommend a wait-and-see rather than hasty guesswork. However, if we dare to look at the direction, it seems that for the time being, it will be accompanied by a decline due to the correction market.

3. FFA Indications

As of May 26, looking at the FFA futures trading price in the 3rd quarter of 22nd, Cape was trading at 35,250, Panamax at 27,950, and Supramax at 29,850. Compared to last week, there was a drop between 1000 and 2000 in all linearities. As mentioned in the previous article, it turned into a decline with a limit on further gains. Considering that the current price in 3Q is not already low, the BDI market is expected to remain flat at the current level for the time being.

Ref) Bulk Carrier Shipping Market (‘22/21W) (tistory.com)

Bulk Carrier Shipping Market (‘22/21W)

As of the 20th, the Baltic Dry Index (BDI), which represents bulk carrier freights, stood at 3,344 points, up 8 percent from the previous week. Freights on the super-large Capesize jumped 14 perce..

shippingmarket.tistory.com

Thanks.

'Dry Bulk' 카테고리의 다른 글

| Bulk Carrier Shipping Market (‘22/24W) (0) | 2022.06.14 |

|---|---|

| Bulk Carrier Shipping Market (‘22/23W) (0) | 2022.06.07 |

| Bulk Carrier Shipping Market (‘22/21W) (0) | 2022.05.24 |

| Bulk Carrier Shipping Market (‘22/20W) (0) | 2022.05.18 |

| Bulk Carrier Shipping Market (‘22/19W) (0) | 2022.05.10 |

댓글 영역