고정 헤더 영역

상세 컨텐츠

본문

International oil prices, which had soared sharply just a few months ago, are declining again due to the economic downturn, inflation, and slowing demand in China. The further decline in oil prices was prevented by the production cut of OPEC+, but we would like to examine the current situation and future supply and demand factors.

1. Crude oil supply and demand status and Brent oil price

1-1. Crude Oil Supply and Demand

- Quarantine measures are strengthened due to the spread of COVID-19 in areas such as Guangzhou, Zhengzhou, and Wuhan, China

- The secretary-general of OPEC explained that there may be an oversupply in the fourth quarter of this year and that a glut is expected in early next year due to high uncertainty about economic growth.

- President Biden mentioned the huge profits of the oil companies, which he said are excessive profits from the war and that oil companies should invest them to ease the burden of US household energy costs and expand production.

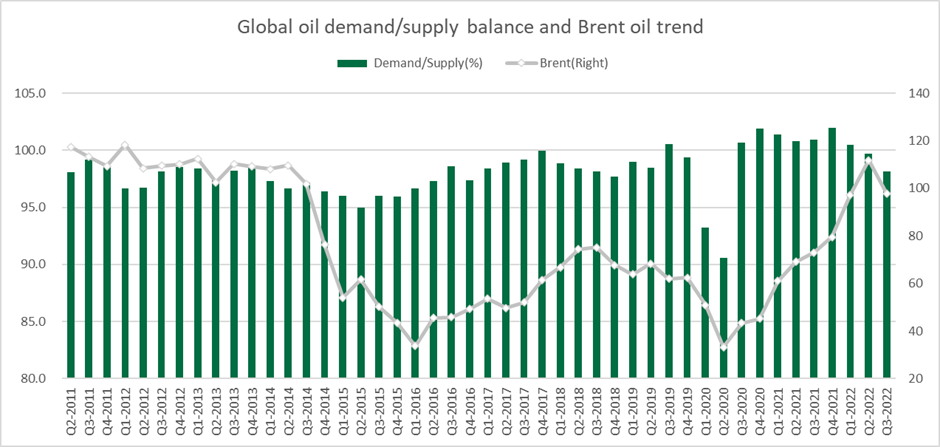

Looking at the demand/supply (%), it exceeded 100 by 1Q 2022, indicating that there was more demand than supply. As demand recovers after Covid-19, demand has outperformed supply for the sixth consecutive quarter from 3Q 2020. At the same time, the price of Brent soared sharply from 3Q20 (43.36$) to 22nd 1Q (97.32$).

As of 3Q 22nd, the supply/demand (%) fell slightly to 98.2, and the average price of Brent oil was also recording $97.8.

1-2. Forecast of global oil demand

International oil price demand is expected to exceed 100 million barrels for five consecutive quarters from Q4 in 22nd to Q4 in 2013. The end of the pandemic is near, and the impact of the economic downturn caused by the rate hike appears to have come to an end. If so, if demand continues to increase while supply is fixed due to production cuts, the price of Brent oil is expected to rise again.

1-3. geopolitical issues

- The WSJ reported that, citing Saudi government officials, Iran was sharing information with the United States about possible attacks on Saudi Arabia and Erbil in northern Iraq.

- Russia and Iran are strengthening cooperation in the energy sector, including oilfield development, oil swap deals, LNG projects, and gas pipeline construction projects

- The US energy envoy Amos Hochstein said that although there is a significant difference of opinion between the US and Saudi Arabia over OPEC+ production cuts, relations with Saudi Arabia will be maintained.

1-4. Finance

The People's Bank of China said it would maintain monetary policy, strengthen support for the real economy, and keep the value of the yuan stable.

The Bank of England has decided to raise rates by 75 basis points, but warns that the UK economy will contract through the first half of 2024 and plunge into the longest recession in history.

- According to the International Monetary Fund, China's economic growth rate this year and next year is 3.2% and 4.4%, respectively, below 5%. rated to stay in %

2. Bunker Oil Price

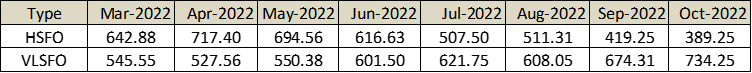

Standard: HSFO (Singapore, 380cst 3.5% Sulfur Price) / VLSFO (Singapore, 0.5% Sulfur Price)

Ship fuel oil (bunker oil) prices are soaring. The price of low-sulfur oil (Singapore) with a sulfur content of 0.5% or less exceeded $700 in October.

The VLSFO price, which had slowed somewhat in August, is attributed to the continued imbalance in energy supply and demand due to Russian sanctions from the West as the cause of low sulfur oil price inflation.

Energy research firm Platts estimates that the monthly demand for bunker oil at Singapore Port is between 2 and 2.5 million tons, but only 1.5 to 1.9 million tons have been supplied in the past few months.

As the price of low-sulfur oil soars, the gap with the price of high-sulfur oil is widening. The price difference, which was maintained at $250-270 in August and September, respectively, exceeded $330 in October 22, and the gap is widening.

Shipping companies are expected to defend their profits by raising fuel surcharges (BAF) and low sulfur surcharges (LSS) due to rising fuel costs.

Thank you

'Commodity' 카테고리의 다른 글

| Check of export/import volume by Ocean/Air major item (0) | 2022.11.25 |

|---|---|

| International Oil price (Brent) (‘22/4M) (0) | 2022.04.28 |

| International Oil price (Brent) (‘22/3M) (0) | 2022.03.27 |

댓글 영역