고정 헤더 영역

상세 컨텐츠

본문 제목

Bankruptcy risk of regular container carriers and profitability check for each carrier

본문

Due to the surge in sea freight rates during the pandemic, the financial status of shipping companies has improved significantly. A bankruptcy risk index based on these financials may not be very meaningful right away. However, if the current market conditions continue, the financial condition of shipping companies will eventually deteriorate again. At that point, we expect the financial position to be in the spotlight again.

Drewry is announcing the Z-Score, which indexes the risk of bankruptcy of the world's major container lines. Based on these indices, let's take a look at the current financial condition of shipping companies as well as their profitability.

1. Comparison of profitability by major shipping companies and by year

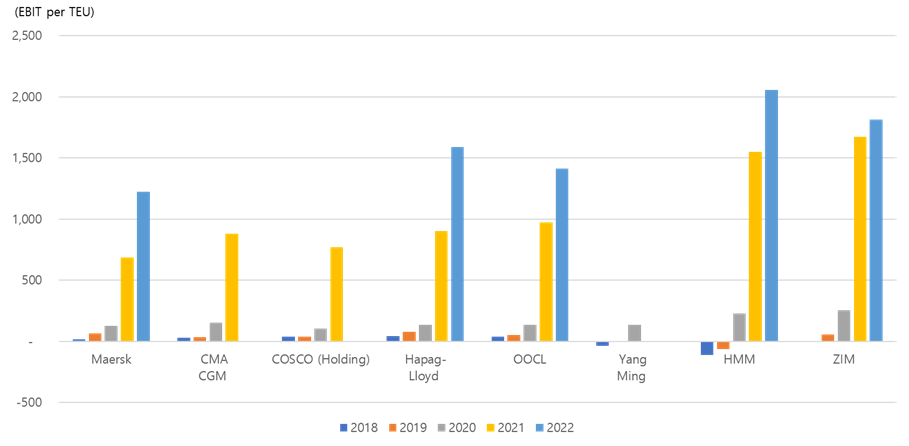

The figure below is a graph comparing the profitability of major container shipping lines over the past five years. You can see EBIT per container (TEU) as a graph of EBIT announced by shipping companies divided by total shipment volume for the year.

Based on aggregate shipping companies, HMM ranked first in profitability in 2022, followed by ZIM. In particular, HMM recorded negative losses at -223, -95, -113, and -63 for four consecutive years from 2016 to 2019, and the huge number of 2,055 (EBIT per TEU) in 2022 broke the previous loss at once. filled it up

Maersk also saw a rapid increase in profitability from 『Year 18: 15』, 『Year 19: 65』, 『Year 20: 126』, 『Year 21: 686』 to 『Year 22: 1,222』, and a total of 13 Looking at total EBIT for the year, 2022 was the most profitable year.

2. Bankruptcy risk check for each shipping company

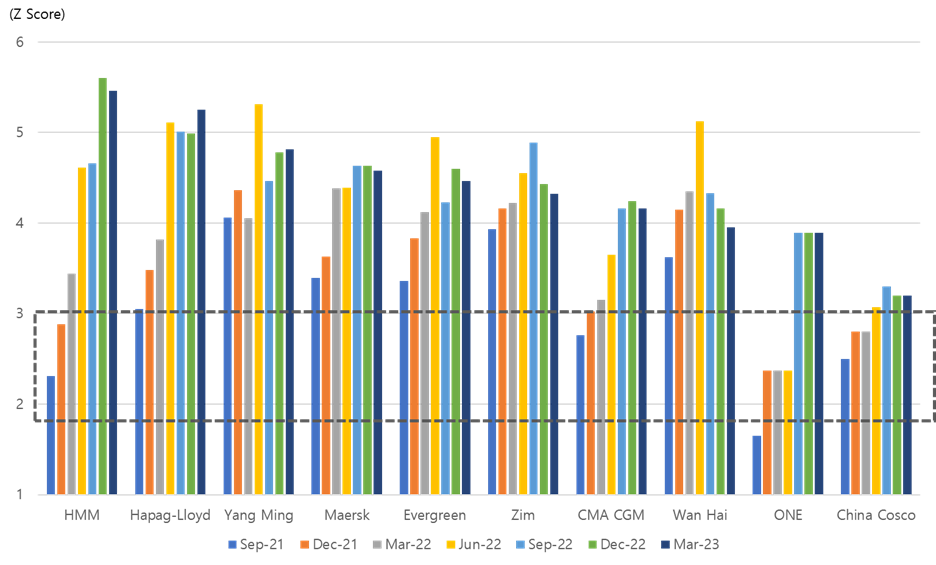

Let's take a look at the financial position of each carrier. Drewry provides a quarterly report by expressing the financial condition of each shipping company as a Z-Score. The Altman Z-Score used here can predict the probability of a company's bankruptcy over the next two years.

The criteria are as follows.

The Z-Score can be divided into 『2.99 or higher: Safety / 1.8~2.99: Caution level / 1.8 or lower is high bankruptcy risk』. At the time of the Lehman Brothers shock, the score was 0.8. Let's take a look at the picture below to see what the current level is.

Certainly, due to the record performance of 2022, the financial status of major shipping companies has improved significantly, and it is confirmed that most of the bankruptcy risks have disappeared. As of September 21, when looking at the Z-score, ONE was below 1.8, and HMM, CMA CGM, and COSCO were below 2.99.

As of March 23, 2023, all of the mentioned shipping companies exceed Z-Score 3, and HMM in particular has the highest score at 5.46.

3. Unit Cost Vs Freight

This time, we will compare the cost and freight rate per container ship TEU in terms of profitability.

Looking at the ‘DIFF of sales and cost per TEU’, in 2Q 2022, it recorded the highest level of profit at around $1,560 per TEU, and in 4Q 22, it plummeted to $730 per TEU along with a drop in freight rates. However, comparing the 19-year average of $30 per TEU and the 20-year average of $115 per TEU, we can see that it is still at a high level.

So how was the first quarter of '23? Assuming based on SCFI rates, it seems to be located between 4Q'20 and 1Q'21. The expected margin rate is expected to be 21-34%. In the end, we will have to see what the profitability of the shipping companies will be like after 2 years of signing a long-term contract based on the current low spot rate.

Thanks.

댓글 영역