Where is the bottom of container freight rates? (2)

(Chapter 2. Container shipping market outlook based on demand)

Where is the bottom of container freight? (tistory.com)

Where is the bottom of container freight?

(Chapter1. Container market status through second-hand and charter rates) There are several factors that affect the freight rate market: 1) supply and demand, 2) market participants' sentiments, 3)..

shippingmarket.tistory.com

Continuing from my last article, this time, I would like to analyze the future container freight rate (SCFI) with a focus on demand. As the analysis data, the analysis was conducted based on the data published by the National Retail Federation (NRF).

1. American Retail Association's Import Volume

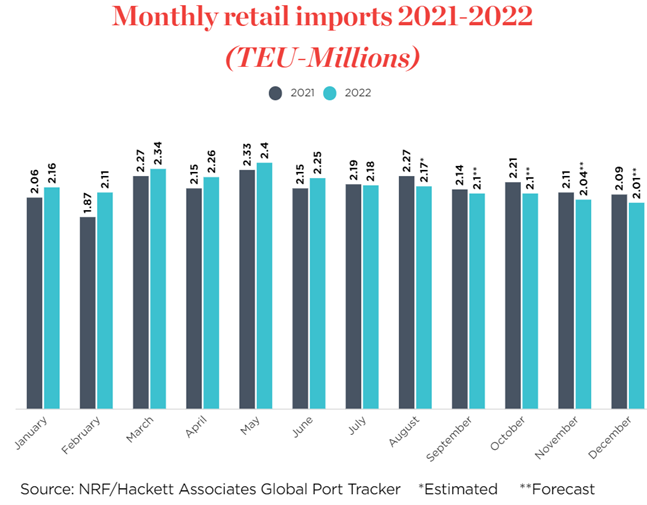

The figure below is a monthly publication of the National Retail Federation (NRF).

In both September/October/November/December 2022, the forecast for retail imports can be seen to decline compared to the previous year. Just looking at retail imports shows that the situation is very negative in terms of demand for the remainder of 2022.

2. Current status of container vessel input by sea route

So, let's take a look at why US retail imports are important for forecasting container shipping rates. If you look at the figure below, you can find out the input amount of container ships by sea route.

In other words, it can be seen that Asia-N.America's vessel input is 5.5M teu, which accounts for the absolute largest share, and the vessel input has increased by 10% compared to August of 2021 due to the recent surge in sea freight rates.

3. Container Freight (SCFI) Outlook

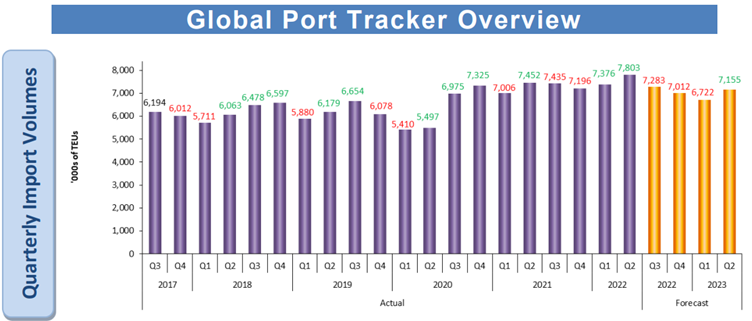

Finally, let's take a look at the NRF's forecasts for marine imports in the 3rd and 4th quarters of 2022 and the 1st and 2nd quarters of 23rd.

The figure above is summarized in the table below for easy viewing.

| Type | 2018 | 2019 | 2020 | 2021 | 2022 | 2023 |

| Q1 | 5711 | 5880 | 5410 | 7006 | 7376 | 6722 |

| Q2 | 6063 | 6179 | 5497 | 7452 | 7803 | 7155 |

| Q3 | 6478 | 6654 | 6975 | 7435 | 7283 | - |

| Q4 | 6597 | 6078 | 7325 | 7196 | 7012 | - |

Although it is clear that the quarterly retail import volume in 2023 will decrease compared to 2021 and 2022, Q1 is expected to increase by 17.7%/14.3% and Q2 by 18.0%/15.8%, respectively, compared to 2018 and 2019, before Covid-19. do. Based on this figure, we would like to forecast the Q1 and Q2 freight rates for FY2023.

1) the 9/7 release date of the NRF and the 9/9 release date of the SCFI are aligned.

2) when each of the above figures is substituted on the basis of the 9/9 SCFI value of 2,562.12, the result is shown in the table below.

That is, the range of the SCFI Q1 value for the year 2023 is 2108 to 2195, and the range of the Q2 value is calculated to be 1896 to 1947.

Thanks.