Bulk Carrier Shipping Market (‘22/30W)

In the bulk market last week, small and medium-sized vessels continued to be strong, while cape vessels continued to roam. On July 22, the dry freight rate index (BDI) closed at 2146, up 28 points from the previous day.

The cape market continued to rise and fall in the North Atlantic, which had led the uptrend last week, due to an increase in ships and a decline in China's iron ore demand. Chinese steel mills said they are considering production cuts as iron ore prices have fallen below $100 per ton and steel production margins have fallen sharply. In addition, Brazilian mining company VALE has also lowered its iron ore production forecast for the second half of the year.

1. Capesize Weekly Trend

1-1. Weekly Market Briefings

◦ Despite the Chinese government's announcement of economic stimulus measures, China's steel and iron ore demand continues to stagnate.

- Operational disruptions in the steel demand industry, including construction operations, continued due to heat waves and flood damage in major regions of China.

- It is said that about 30 of the iron ore currently being shipped and being transported to China have not yet secured a buyer.

◦ As steel production margins at steel mills fell to a negative level, it is understood that about 20 steel mills in China are considering production cuts for the next two to three months.

- The slump in iron ore demand worsened due to increased production cuts in steel mills, and the international iron ore price fell below $100/ton.

- Vale lowered its iron ore production forecast for this year by up to 15 million tons to 310-320 million tons in consideration of sluggish demand in China and falling international iron ore prices.

1-2. Technical analysis

MACD : July 11, 2022, Trade signal (Long position establishment) signal generated.

2. Panamax Weekly Trend

2-1. Weekly Market Briefings

◦ China's coal import demand is not strong due to an increase in its own coal production. However, in order to respond to the increase in electricity demand due to the recent heat wave, coal imports are being gradually resumed..

- However, the increase in import demand is limited due to abundant domestic procurement, such as China's coal production in June recorded 380 million tons, an increase of 15% compared to the same period of the previous year.

◦ The recovery is expected to continue this week due to the effect of the conversion of cargo from the Atlantic Ocean to the Cape and the expansion of coal demand in the Northern Hemisphere.

2-2. Technical analysis

MACD : July 22, 2022, Trade signal (Long Position establishment) signal occurred.

3. FFA Indications

As of July 21st, looking at the FFA futures trading price in 3Q22, the cape traded at 24,075. Considering the fact that it currently trades higher than the spot, it can be seen that bets are being made on the rise of the market ahead of the peak season. Since both Panamax and Supramax are showing the same contango, we strongly recommend a long position on BDI, which encompasses all linearities.

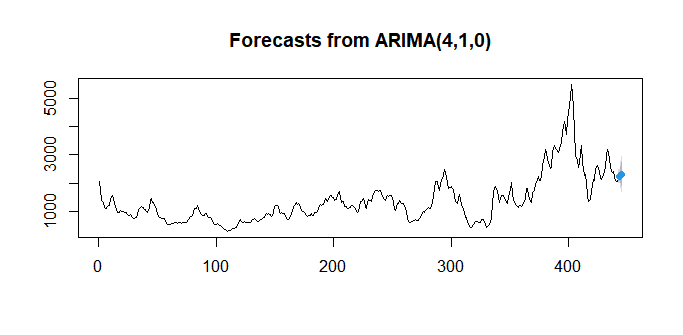

4. ARIMA, Time series analysis

For the BDI forecast, I used weekly data (442 pieces) from January 3, 2014 to July 22, 2022 to predict the freight for three weeks in the future.

| Date | Forecast | Trend(WoW) |

| ‘22/30W(7/25~29) | 2,226.495 | ↗ |

| ‘22/31W(8/1~5) | 2,282.129 | ↗ |

| ‘22/32W(8/8~12) | 2,303.254 | ↗ |

As shown in the table and figure above, BDI (as of 7/22: 2,136.80) rose 4.2% from the previous week (as of 7/15: 2,051.00). The rebound after stopping the three-week downtrend is also meaningful, but since it rebounded with a large rise, it is likely to bottom out and turn into an uptrend. It seems that we should continue to pay attention to China's economic policy.

As a result of reflecting the latest trends, the ARIMA model also predicted that BDI would continue to rise for the next three weeks.

Ref) Bulk Carrier Shipping Market (‘22/28W) (tistory.com)

Bulk Carrier Shipping Market (‘22/28W)

As of the 8th, the Baltic Freight Index (BDI), which shows the bulk carrier market conditions, fell 6.6% from the previous week to 2,067 points, and demand volatility is high amid concerns about a..

shippingmarket.tistory.com

Thanks.